A closer Look at energy efficiency investment opportunities for institutional investors

Talks with potential financiers in germany, austria and switzerland

In order to attain the energy transition which is a basic condition for climate protection, a scaling up of energy efficiency (EE) activities is necessary. However, EE projects are frequently confronted with financial barriers. The objective of the following analysis is to determine how EE projects can be supported with liquidity through instruments of refinancing via the capital market. Hereby, the analysis focused specifically on financing opportunities in German-speaking regions.

The interviews, which provide the basis of the analysis were conducted over a period of 4 months from December 2021 to April 2022 and were held with current and prospective investors in ”green financing”.

In the discussions, market participants came up with suggestions on how EE projects can be financed via the capital market. The following financing instruments were considered:

- Alternative Asset Funds: Securitisation and bundling of accounts receivables

- Private Investment Company

- Crowdfunding

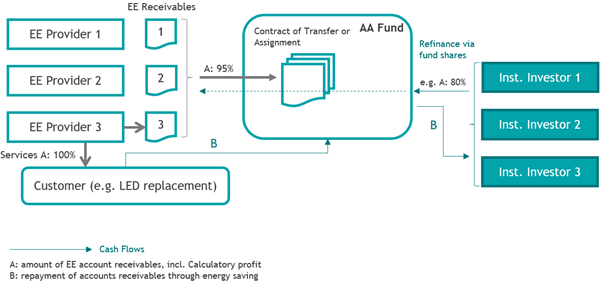

Alternative Asset (AA) Fund – Securitisation and Bundeling of Accounts Receivables

The idea of securitization is to bundle individual account receivables into a fund in order to be able to offer it on the capital market to professional investors, i.e., pension funds, banks, fund companies, insurance companies, etc. In terms of legal classification, the fund qualifies as an Alternative Asset Fund.

Following points became apparent during our discussions:

- Necessary legal framework is just given in Luxembourg and Liechtenstein. This is due to the fact that the national banking laws require a separate credit check for the account receivable, and this check cannot be carried out organizationally and technically by many professional investors. Technically, this means that regular pricing and application for an ISIN (International Securisation Identification Number) are necessary. Within the EU and associated territories this financing instrument can just be realized within the legal framework of Luxembourg and Liechtenstein.

- A key characteristic of this financing instrument is the guaranteed repurchase of fund units in order to maintain the liquidity of the investment for the investor. On the one hand, it quickly became apparent in the discussions that implementation can only be realized in an economically sensible way within the legal framework of Luxembourg in order to keep transaction costs low. There are also some capital market-related companies that offer the management of fund shells as a standard solution.

- Lack of experience in energy efficiency. It also became apparent that there are significant gaps in the occupation of the roles that are also required by law, i.e., fund manager, risk manager, settlement agent in the event of a default of the debtor of the receivable, custodian bank and valuer. In fulfilling the requirement to assign qualified experts to the roles, it was difficult to locate experts with experience in the area of energy efficiency measures. This can be explained by the fact that there is hardly any experience with financing EE measures via the capital market, and the low volumes have so far created very little interest on the provider side.

- Increase in importance of sustainable projects. Strong interest in sustainable projects with in this context, however, it also became apparent that the increased socio-political importance of sustainable projects and the associated investments are driving a fundamentally strong interest. This results in a contradiction between the desire for supply and reality.

Private Investment Company

Another option discussed, which is similar to the approach using an alternative asset fund, is the establishment of an investment company that buys up the accounts receivable and refinances them by issuing bonds.

Different possibilities:

- These bonds can also be structured as subordinated bonds.

- An additional variant for the investor is to be directly involved in the investment company.

- During the discussion a smaller group of investors who are willing to take higher risk in exchange for higher returns has also proposed the implementation of an investment company. However, this option is not appropriate for the typical institutional investor. Due to regulatory requirements, most investors are not in a position to invest larger volumes in investment companies.

Crowdfunding

Crowdfunding was also discussed in the course of the analysis of financing options. Crowdfunding has experienced very strong volume increases in recent years, especially in the area of real estate financing.

- Advantages of Crowdfunding are that it is still a relatively young form of financing and can therefore be shaped in terms of content and especially small to medium-sized EE projects could be financed via crowdfunding.

- Nevertheless, there are limits due to the restriction to private investors and the subordination of the investments. For institutional investors, the desired project relevance can be achieved through investment companies. These companies invest in EE projects and in turn issue bonds that institutional investors buy into their investment portfolios.